Litigation Funding for Investors and Private Equity Companies

Enabling you to focus on your core business activities.

Investors and private equity companies can greatly benefit from litigation funding support

Investors and private equity companies benefit from using litigation funding to support their work by accessing an alternative asset class that provides attractive risk-adjusted returns uncorrelated with financial markets. Additionally, litigation funding allows them to diversify their investment portfolios and potentially achieve higher returns by investing in a broad range of legal claims with strong merit and significant potential for recovery.

Deminor’s team structure lends itself to being an ideal litigation funding partner for investors and private equity companies, due to the case team being made up from solely legal professionals, enabling our team to quickly provide initial assessments on the viability of any potential litigation your organisation may be facing.

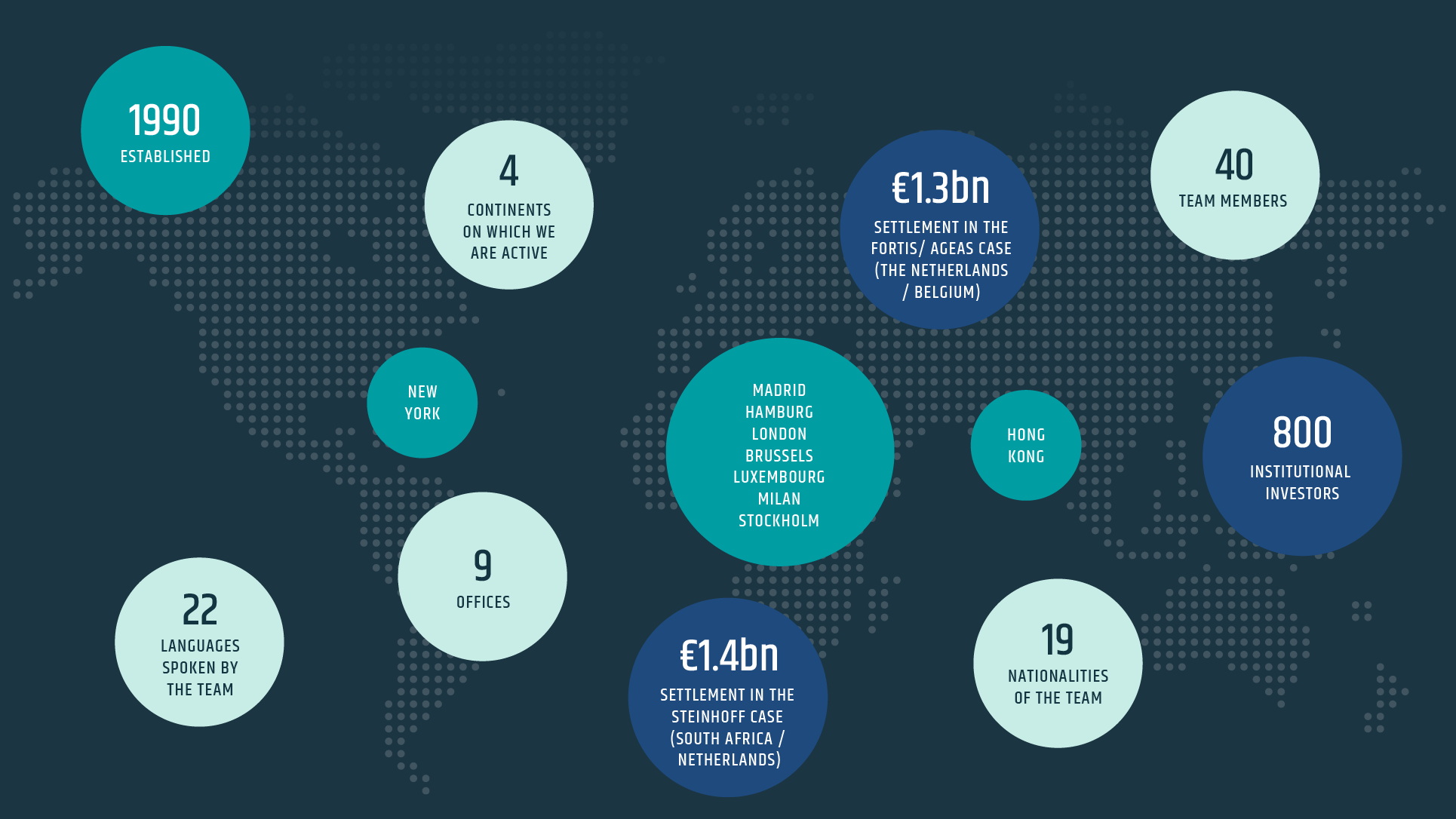

In addition, with 9 global offices, containing staff from19 nationalities and speaking 22 languages, Deminor is well-placed to support a diverse array of single and multi-jurisdictional claims.

Why are more investors and private equity companies turning to litigation funding to accelerate their growth and business performance?

- Portfolio Diversification: Litigation funding offers investors and private equity firms an alternative asset class that can diversify their investment portfolios and reduce overall risk exposure.

- Attractive Returns: Litigation funding can provide investors with attractive risk-adjusted returns, as successful legal claims can result in substantial financial awards or settlements.

- Non-Correlation with Financial Markets: Investments in litigation funding are typically uncorrelated with traditional financial markets, offering investors a hedge against market volatility and economic downturns.

- Access to Legal Expertise: Litigation funding companies often have access to legal expertise and resources, including experienced lawyers and litigation support services, which can enhance the effectiveness and success of legal actions pursued by investors and private equity firms.

- Risk Mitigation: By providing funding for legal expenses, litigation funding companies help investors and private equity firms mitigate the financial risks associated with pursuing legal claims, as funding is typically non-recourse, meaning repayment is only required if the case is successful.

- Enhanced Deal Flow: Litigation funding companies provide investors and private equity firms with access to a broad range of investment opportunities in legal claims with strong merit and significant potential for recovery, thereby expanding their deal flow and investment options.

- Strategic Litigation: Investors and private equity firms can use litigation funding to strategically pursue legal claims that align with their investment objectives, such as enforcing contractual rights, protecting intellectual property, or seeking damages for corporate wrongdoing.

Overall, investors and private equity companies use litigation funding to diversify their portfolios, achieve attractive returns, mitigate risk, access legal expertise, enhance deal flow, and strategically pursue legal claims that align with their investment strategies and objectives.

Why Deminor?

As you will see from the statistics below, Deminor has the experience, international footprint and size to support your litigation funding needs.